-

NOWOŚĆ

Zdobądź do

1 200 000 zł Stały % spłat dostosowany do Twoich obrotów w P24

Automatyczna spłata z obrotów w P24.

Pieniądze na dowolny cel.

Chcę skorzystaćSzybka decyzja, zero ukrytych kosztów.

-

PODCASTWIDEO

Jak Połączyć E-commerce

ze Sklepem Stacjonarnym

Obejrzyj odcinek

Podcast S02 E09 -

NOWOŚĆ

Sprzedaż spada? Promuj raty

trending_flatDocieraj do nowych grup klientów

trending_flatZwiększaj średnią wartość koszyka

trending_flatPrzeprowadzaj atrakcyjne akcje promocyjne

Dowiedz się więcej -

NOWOŚĆ

Nowy w

e-commerce? Nie przyjmowałeś płatności online w ciągu ostatnich 12 miesięcy? Dołącz do Programu Polska Bezgotówkowa z Przelewy24 i zyskaj:

0% prowizji za płatności kartą przez rok

Więcej informacji0zł za uruchomienie płatności online

-

NOWOŚĆ

Click to Pay - Kliknij, zapłać i gotowe!

Prosty sposób na płatności internetowe.

Poznaj Click to Pay -

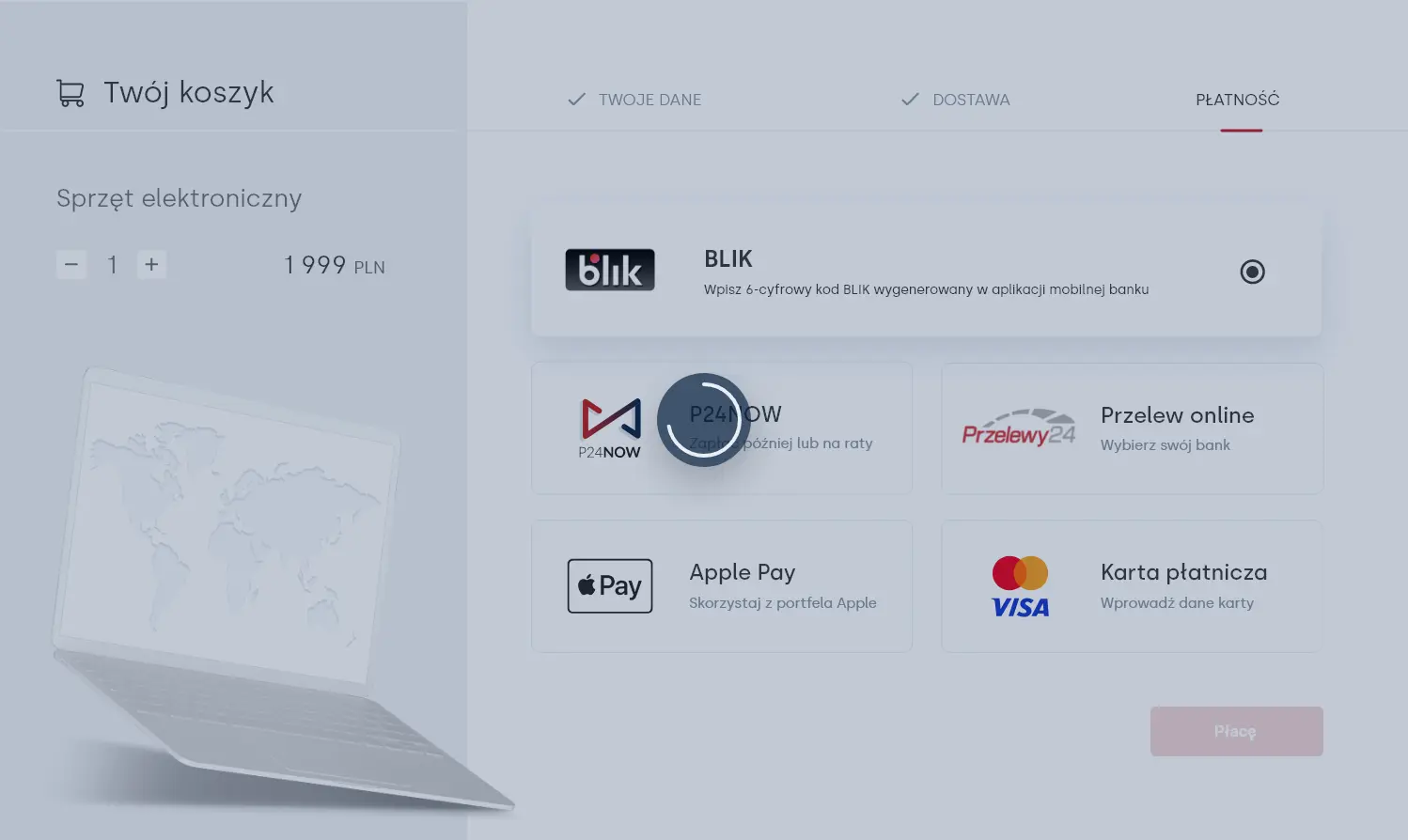

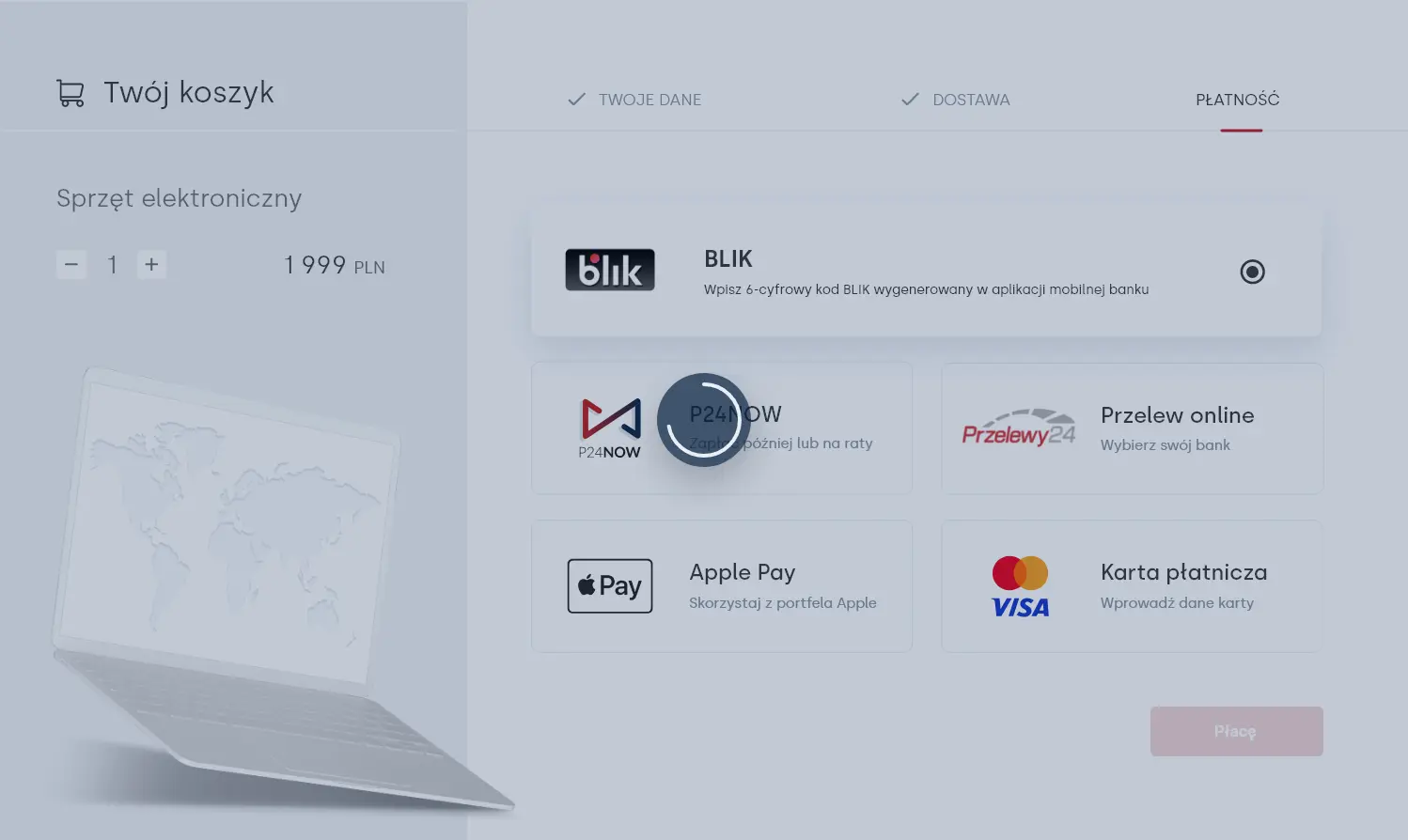

BLIK Płacę Później w Przelewy24

Pozwól klientom na prostą i wygodną płatność odroczoną nawet do 30 dni. Obecnie dostępne dla klientów VeloBank i Millenium.

Poznaj BLIK Płacę Później -

Nowa metoda Visa Mobile

Płatność kartą bez karty? Tak, to możliwe. Teraz wystarczy podać tylko numer telefonu.

Poznaj Visa Mobile -

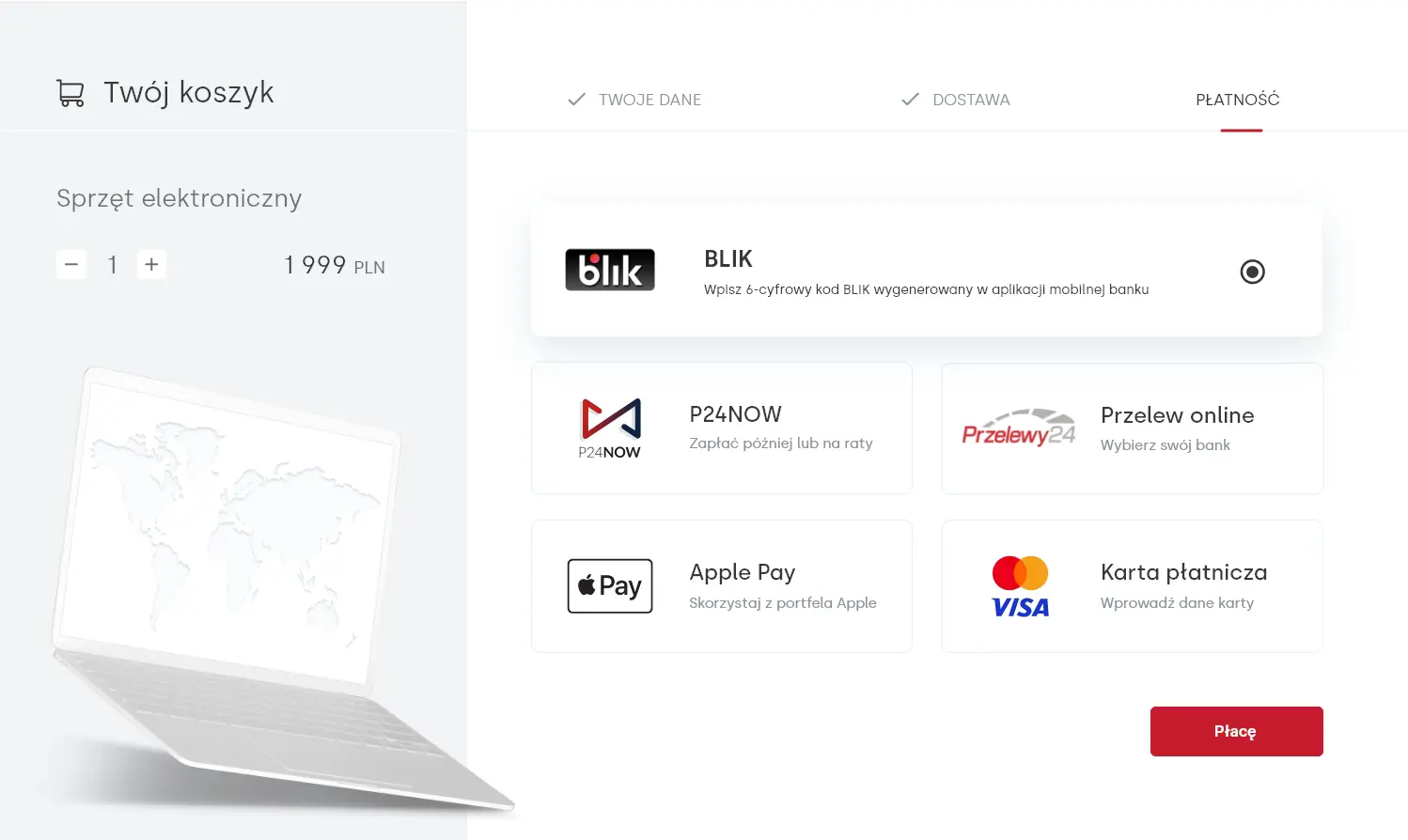

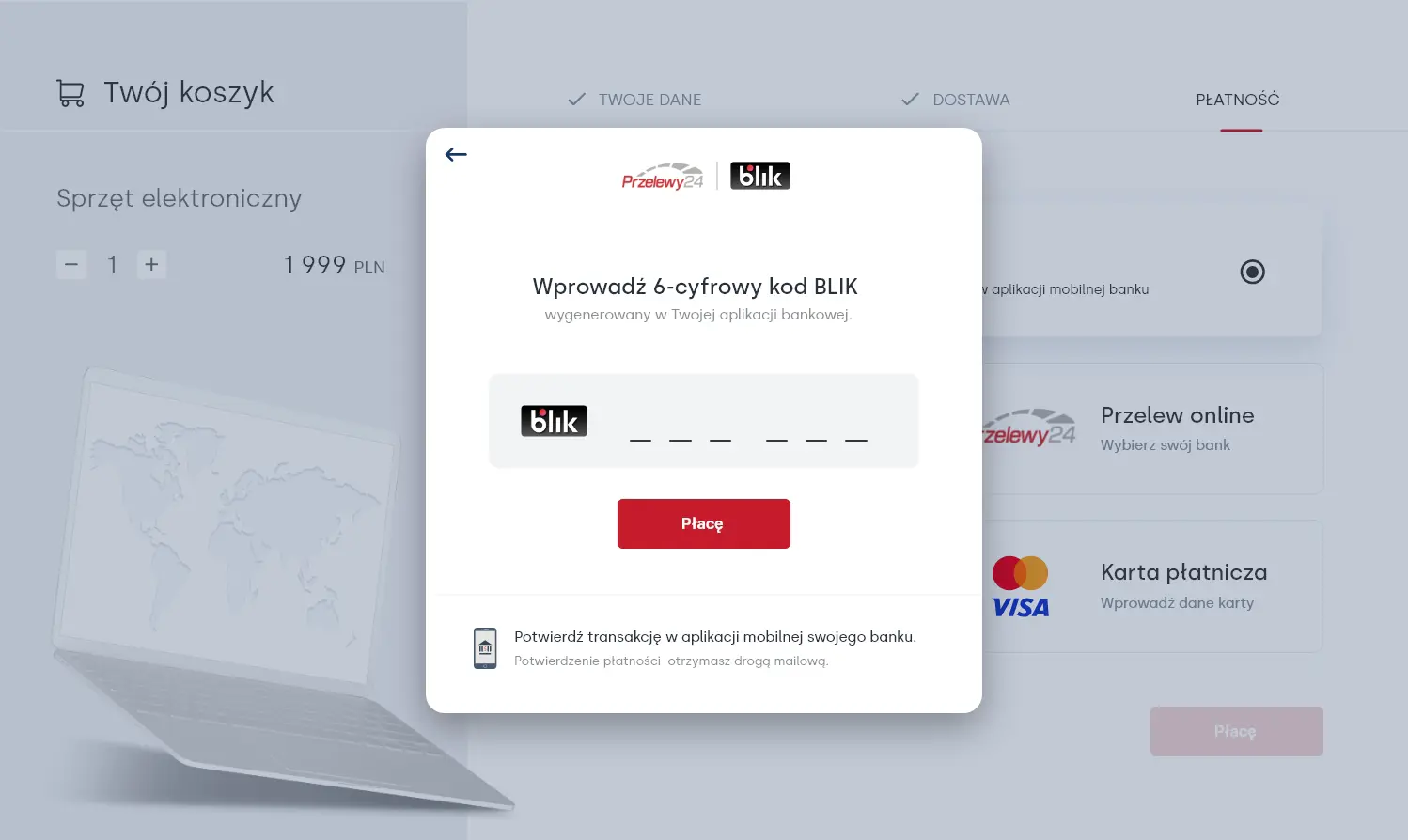

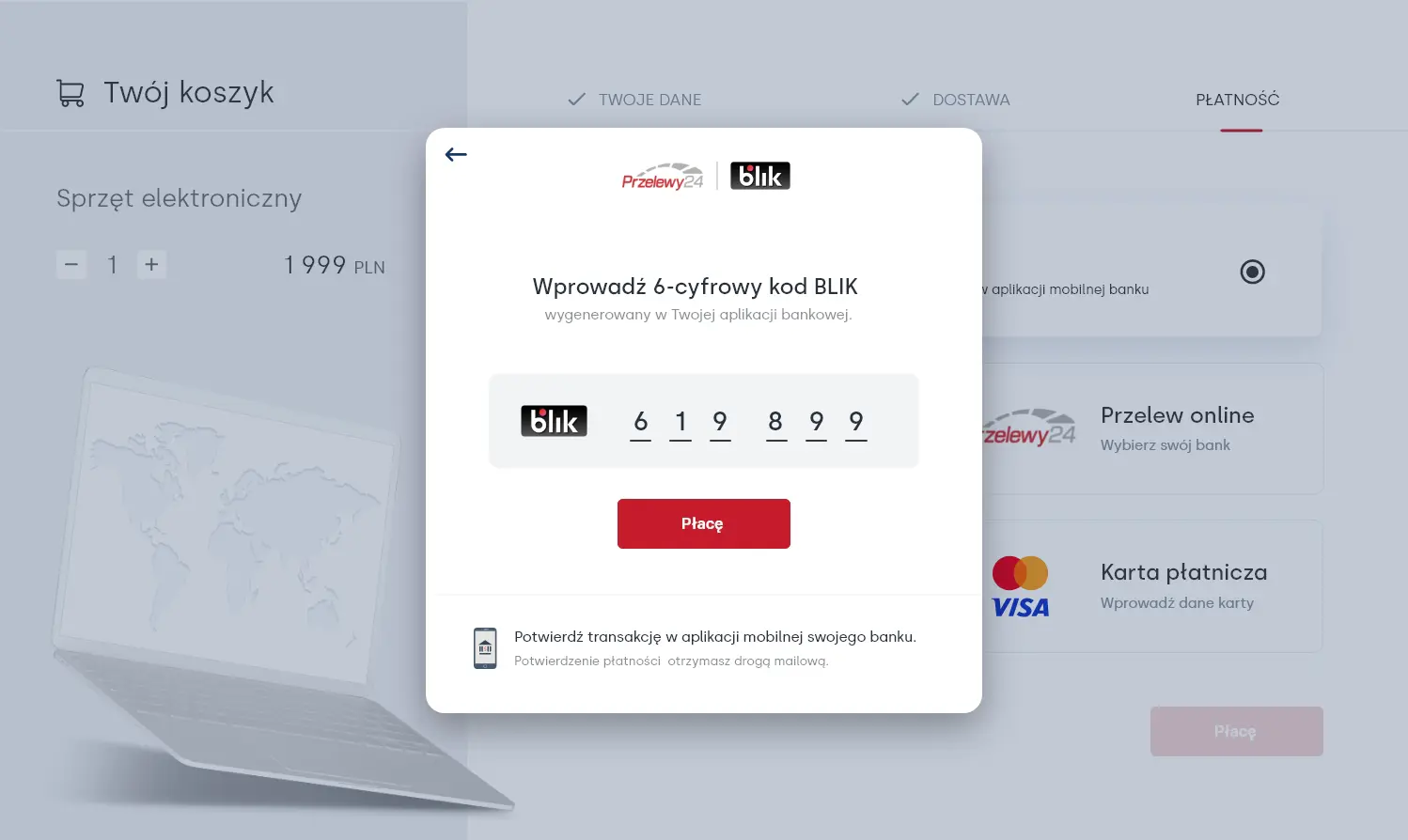

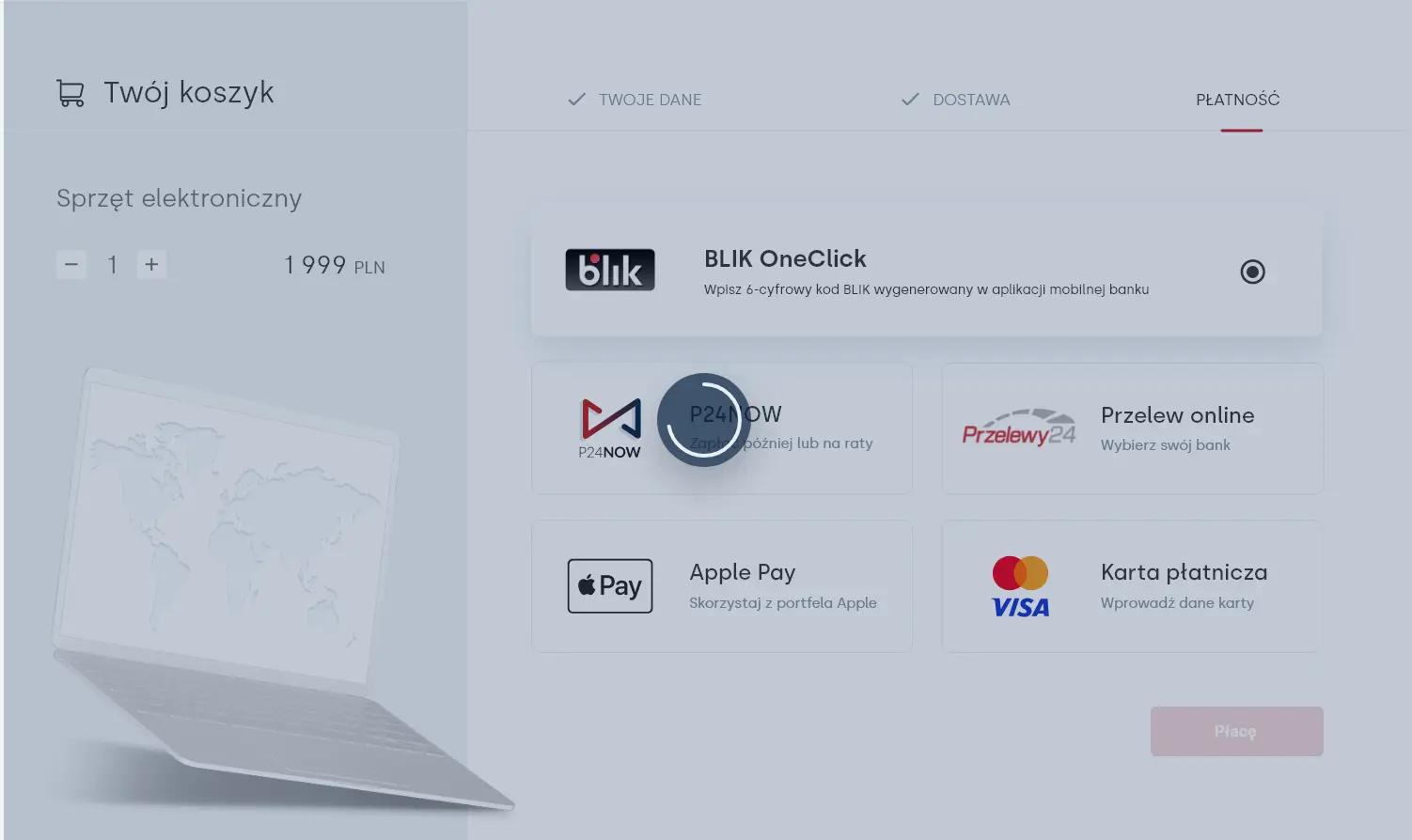

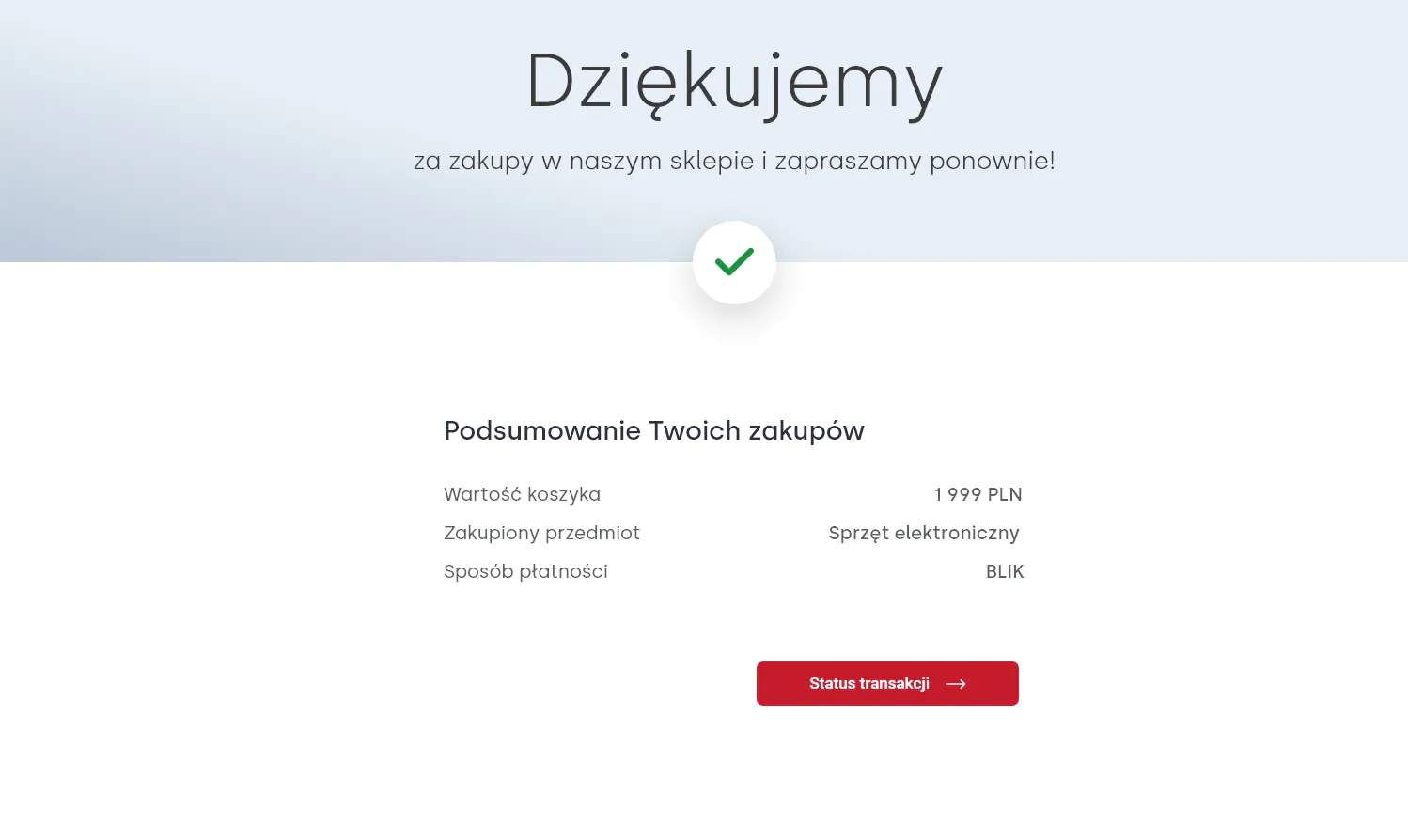

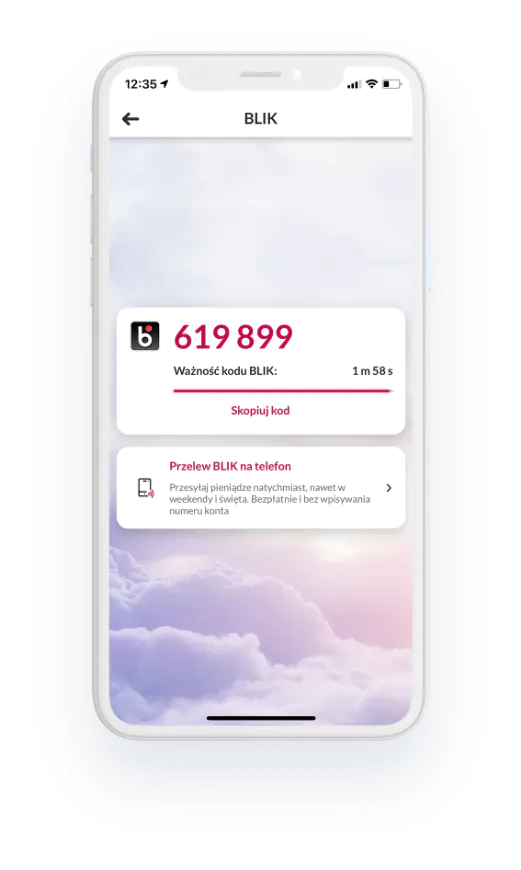

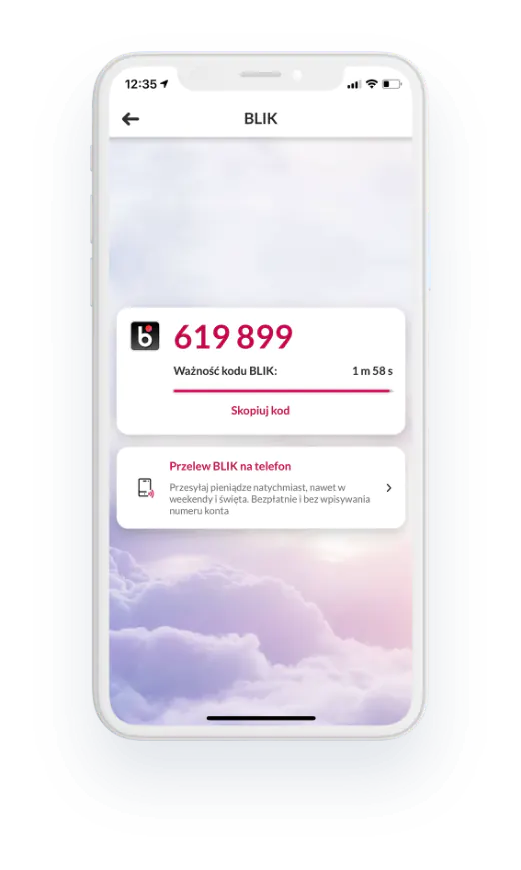

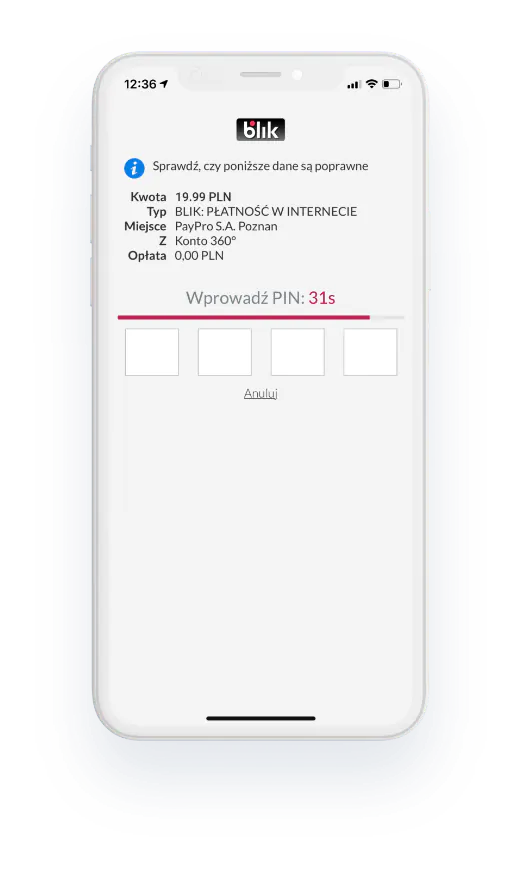

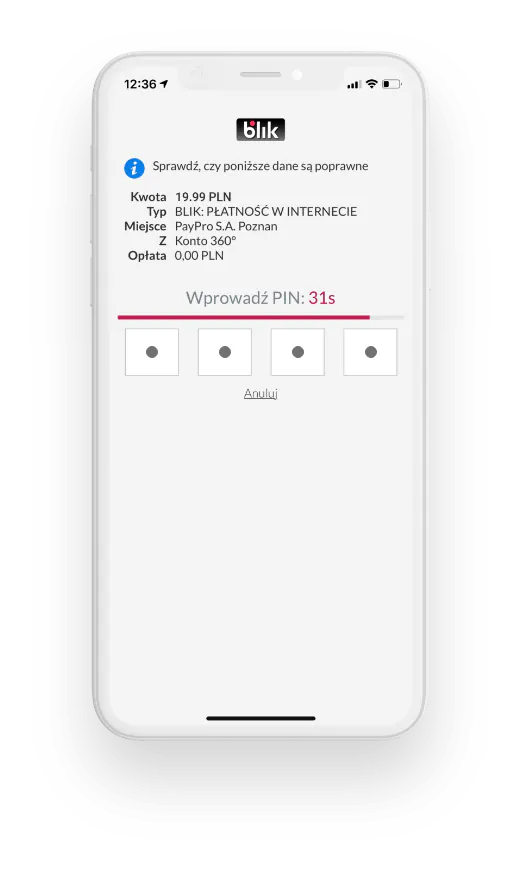

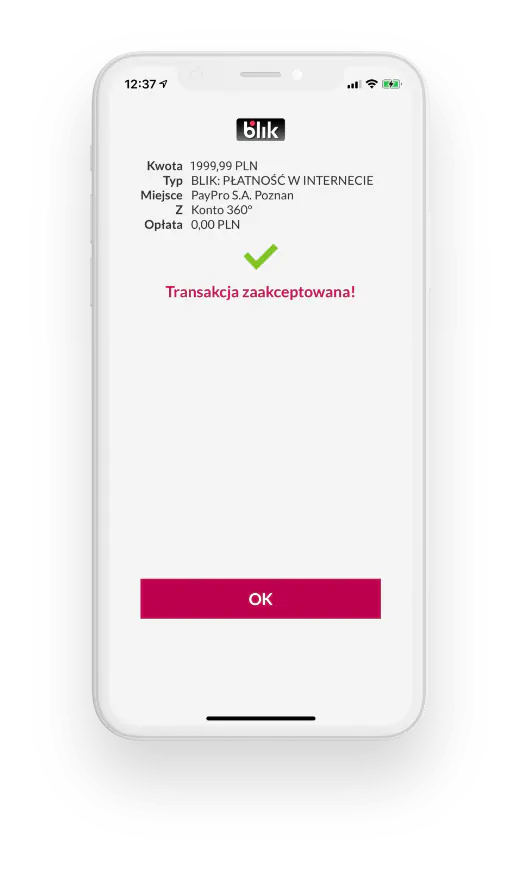

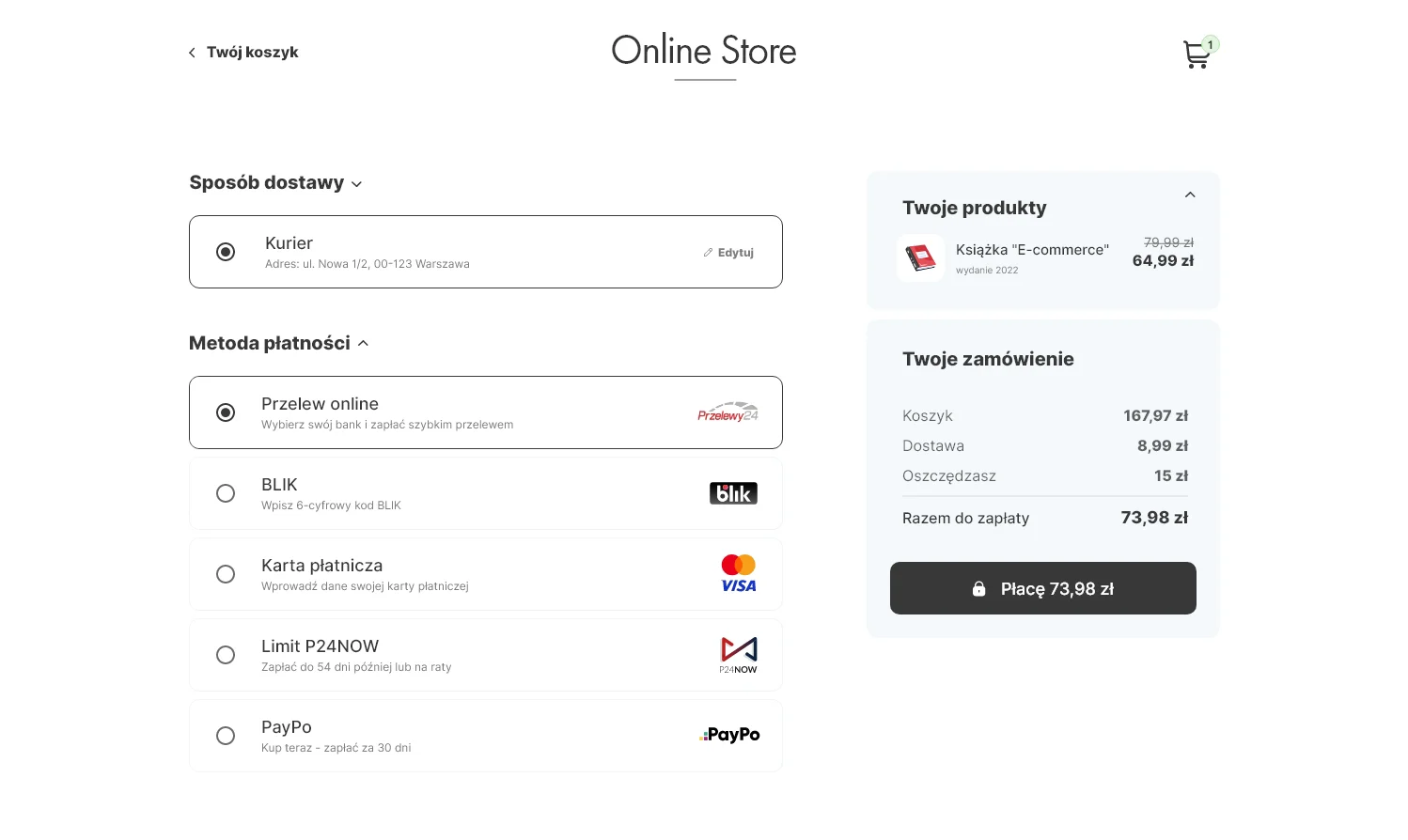

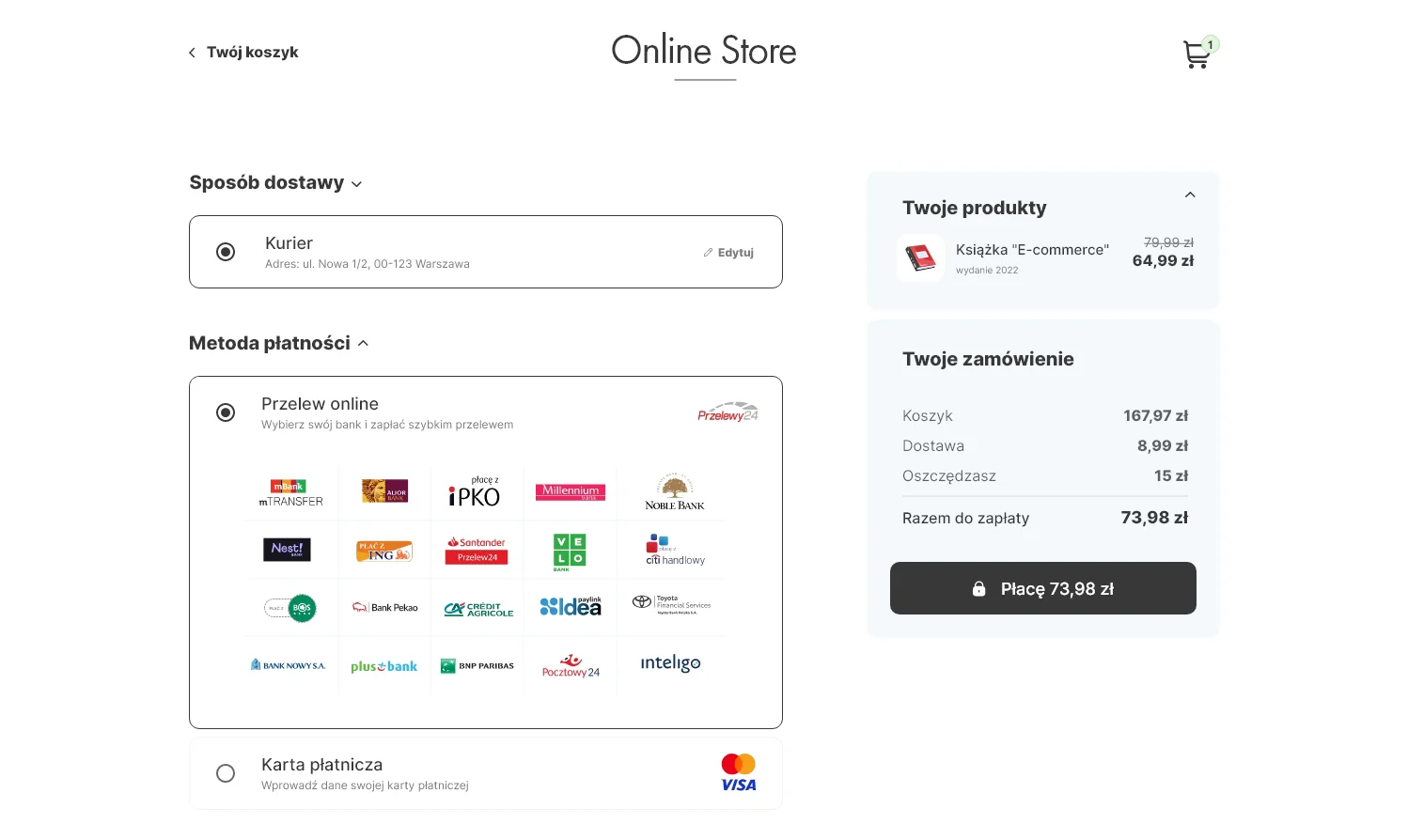

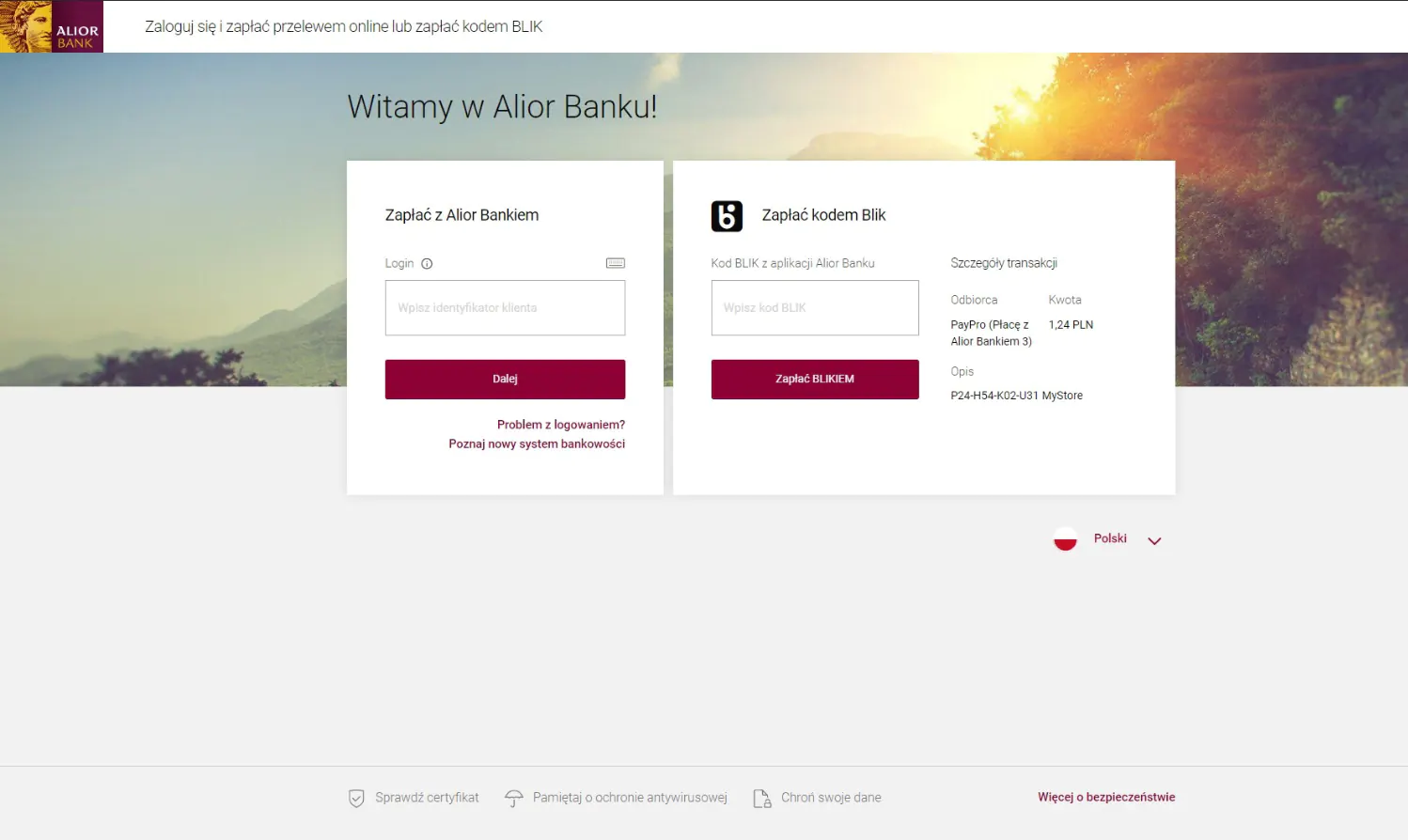

Zakupy w stylu BLIKA

Płatność 6-cyfrowym kodem albo… jednym kliknięciem. Sprawdź wszystkie możliwości BLIKA.

Poznaj BLIKA